Maximise Your Superannuation with Investments in SMSF

Unlock the potential of your super with strategic property investment.

Turn your Superannuation into a powerful property portfolio

Control Your Investments

Use leverage to your advantage. 3-4 x your asset base, poised for long-term growth

Maximise Leverage

Unlock benefits available to SMSF property investors, in a low tax environment

Utilise Tax Advantages

Property within your SMSF is a proven path to sustainable wealth creation

Build Long Term Wealth

Take full control of your super with direct property ownership through your SMSF

Turn your Superannuation into a powerful property portfolio

Take full control of your super with direct property ownership through your SMSF

Control Your Investments

Use leverage to your advantage. 3-4 x your asset base, poised for long-term growth

Maximise Leverage

Unlock benefits available to SMSF property investors, in a low tax environment

Utilise Tax Advantages

Property within your SMSF is a proven path to sustainable wealth creation

Build Long Term Wealth

Grow smarter - see how leverage multiplies results

By leveraging your capital, you can control a larger asset and benefit from its full growth potential.

Disclaimer: This graph is for general information purposes only and does not constitute financial advice. Past performance is not a reliable indicator of future results. You should seek independent professional advice before making any investment decisions.

Investing in property through your SMSF gives you greater control, flexibility, and potential for higher returns. Unlike traditional super, you can directly own tangible assets, use strategic leverage, and build long-term wealth within a tax-effective structure.

The SMSF Property Advantage

Traditional Super

Limited investment choices

No direct control

Standard market returns

Limited opportunity for leverage

Standard 6-8% returns*

SMSF Property Investment

Direct property ownership

Full investment control

Rental income + capital growth

Boost portfolio with leverage

*Indicative returns based on historical performance. Past performance is not indicative of future results.

Leveraged up to 30% returns*

Strategy Session

(with Advisor)

We work with your accountant to confirm alignment with your SMSF investment strategy.

Simple steps to SMSF property investment

2. Research & SMSF-Compliant Shortlist

Source high-growth, ATO-compliant investment properties presented for adviser review.

5. Ongoing

Support

3. Acquisition & LRBA Structuring

Manage negotiations and coordinate LRBA requirements with lenders and your adviser to ensure compliance.

Provide ongoing support for refinancing, portfolio growth, and strategy updates as your SMSF evolves.

4. Settlement & SMSF Setup

Oversee documentation, bare trust setup, loan structure, and settlement to ensure correct SMSF ownership.

Invest smarter. Build faster. Achieve more.

Speak with a property expert and uncover the smartest path to achieving your investment goals - before the market moves again.

Simple steps to SMSF property investment

2. Research &

SMSF-Compliant Shortlist

1. Free Strategy

Session

We work with your accountant to confirm alignment with your SMSF investment strategy.

Source high-growth, ATO-compliant investment properties presented for adviser review.

4. Settlement &

SMSF Setup

Oversee documentation, bare trust setup, loan structure, and settlement to ensure correct SMSF ownership.

3. Acquisition &

LRBA Structuring

Manage negotiations and coordinate LRBA requirements with lenders and your adviser to ensure compliance.

5. Ongoing

Support

Provide ongoing support for refinancing, portfolio growth, and strategy updates as your SMSF evolves.

Invest smarter. Build faster.

Achieve more.

Speak with a property expert and uncover the smartest path to achieving your investment goals - before the market moves again.

-

Navigate complex SMSF regulations with confidence. We ensure every property meets compliance requirements.

-

Access exclusive off-market properties and negotiate under-market purchases through our extensive network.

-

Every recommendation is based on investment fundamentals - rental yield, growth potential, and market dynamics.

-

From initial strategy to ongoing portfolio management, we're with you every step of your investment journey.

We specialise in finding compliant, under-market properties that deliver strong returns for SMSF investors. Here's why investors choose Properly.

Your SMSF Property Experts

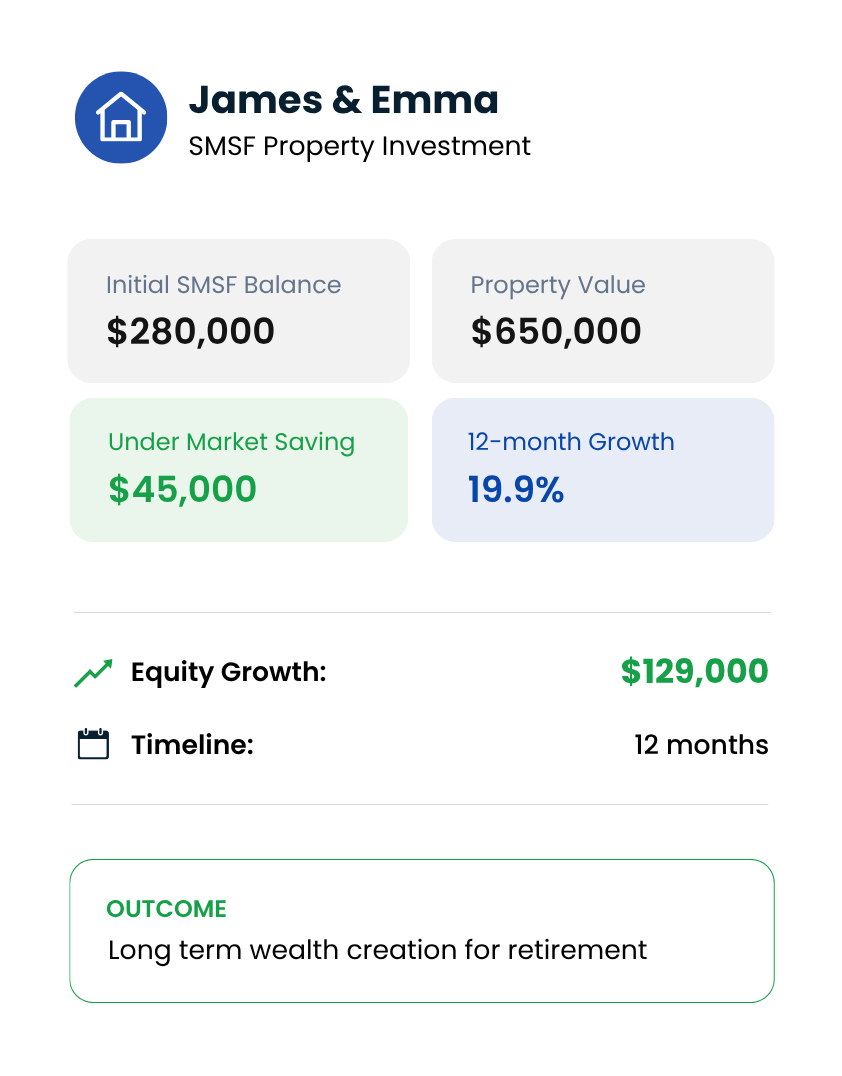

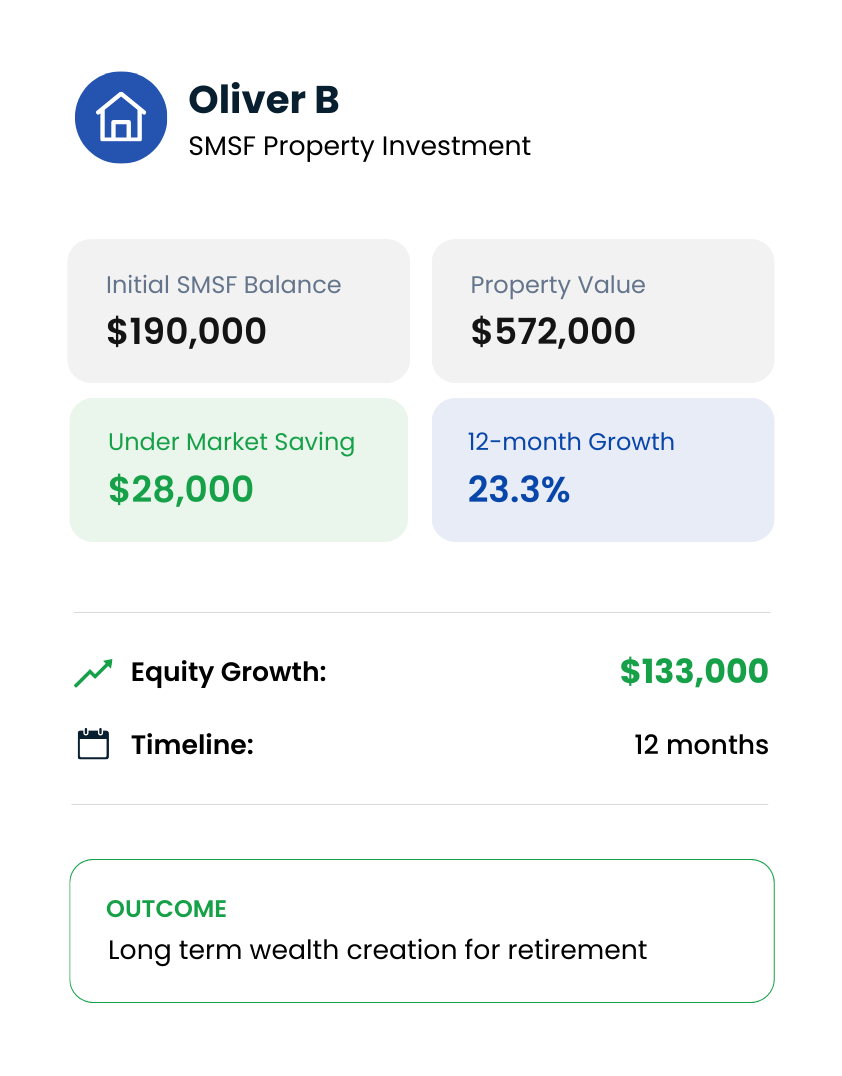

See how Properly has helped SMSF investors turn their super into powerful property portfolios with measurable results.

Real Investors, Real Results

SMSF Property Investment: Common Questions

-

An SMSF property investment involves using your Self-Managed Super Fund to purchase property as part of your retirement strategy. The property is owned by the fund, and any income or capital growth goes back into your super for long-term wealth creation.

-

Yes — under a structure called a Limited Recourse Borrowing Arrangement (LRBA), your SMSF can borrow to purchase property. The loan is secured only against the property, protecting the rest of your fund’s assets.

-

An SMSF can buy residential or commercial investment properties, as long as the purchase complies with superannuation laws. The property must be solely for investment purposes — not for personal use or related parties.

-

No. SMSF investment properties must meet the ‘sole purpose test’ — they can’t be used by you, your business, or your relatives. All rental arrangements must be at arm’s length and on commercial terms.

-

SMSF property investment offers control, leverage, and potential tax advantages. It allows you to directly choose assets, use super savings to invest in real property, and benefit from concessional tax rates on income and capital gains.

-

Like any investment, there are risks — including property market fluctuations, liquidity constraints, and strict compliance rules. It’s important to seek professional advice before proceeding to ensure it aligns with your fund’s strategy.

-

While there's no legal minimum, we typically recommend at least $200,000 in your SMSF to make property investment viable. This allows for a deposit, associated costs (stamp duty, legal fees, etc.), and maintaining adequate cash reserves for ongoing expenses and compliance requirements.

-

Typical costs include setup and ongoing SMSF fees, loan establishment costs, legal and accounting fees, stamp duty, and property management expenses. A clear cost breakdown helps ensure your investment remains financially sound.

-

All rental income and future capital gains go directly back into your SMSF, taxed at concessional rates. Over time, this can significantly boost your retirement savings through compounding growth.

-

A buyers agent helps you identify compliant, high-performing properties that suit your SMSF strategy. We handle research, sourcing, and negotiation — ensuring your fund invests strategically and confidently.